Research and impact | By Hamish Armstrong

Levelling the gender playing field in M&A

Bayes Business School’s Dr Valeriya Vitkova finds negative perception of female-led deals to be unjustified, with women completing more deals and achieving higher share price returns than their male counterparts.

The topic of boardroom gender diversity and the advantages it can bring a company have been long-defined, yet industries still struggle to attract female directorship – or seem to ignore these proven benefits.

It is a similar story in the mergers & acquisitions market, which tends to regard female-led deals less favourably in terms of shareholder returns on announcement than those conducted by male-dominated counterparts. However, studies from Dr Valeriya Vitkova, Research Fellow at the Bayes Mergers & Acquisitions Research Centre (MARC) commissioned by SS&C Intralinks find little justification for this mindset.

In fact, Dr Vitkova’s research finds that acquisitions led by female CEOs or companies with at least 30 per cent female representation at board level perform better overall, linked to their deal making characteristics, which was only further demonstrated during the Covid-19 pandemic.

Despite deals conducted by female CEOs attracting acquirer share price returns 1.5 percentage points lower for a 40-day announcement window than those led by males, these same transactions resulted in higher overall share price returns of 7.1 per cent along with a 7.9 percentage point rise in return on equity over a three-year period.

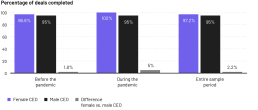

Similarly, 97 per cent of deals with significant (30 per cent or more) female representation at board level were completed, versus 95 without. In the pandemic period, 100 per cent of all female-led or represented deals were finalised.

Reflecting on the study, Dr Vitkova says that despite recent progress there is still a long way to go towards recognising, valuing and putting into action female performance in mergers and acquisitions.

“While demonstrating the undoubted value of diversity in boardrooms, the results suggest a lot of effort required to shift negative perceptions of women in M&A,” she says.

“We only have to look at the relative performances of female and male-led acquisitions during the pandemic to realise the significant positive influence that women have in the industry, especially at a time of great uncertainty where characteristics of caution certainly came to the fore. The sad reality, however, is that this still does not translate into market confidence or valuation.”

Among the other findings uncovered by Dr Vitkova’s research is the revelation that females and the companies they lead have different deal-making characteristics to those of males, which could go a long way towards explaining the differences between both in perceived and actual performance. Female-led acquirers are more likely to seek external advice and strong growth targets, while displaying a more cautious approach to deals by offering assurance such as reverse termination fees. Male-dominated boardrooms, meanwhile, have a generally greater appetite for risk in deals.

Dr Vitkova added that organisations and investors should look to embrace these differences and see gender diversity as a strength rather than a hindrance.

“The barriers of unconscious bias and historical norms within M&A and the workplace in general must be overcome for the global market to thrive,” she continues.

“Legal and advisory structures must be put in place to provide access to top roles for women alongside men, and directors should be educated on the benefits that gender diversity can bring to an M&A transaction.”